In the audit cycle, an auditor follows a few steps for valid and accurate financial information. It consists of 5 key steps: Defining standards and criteria; Collection of data; Analyzing results; Implementing changes; Re-auditing the collected information; And it's done!

[video width="928" height="720" mp4="http://pikvan.com/wp-content/uploads/2020/06/A.1.mp4"][/video]

Employee Stock Option Plan (ESOP)

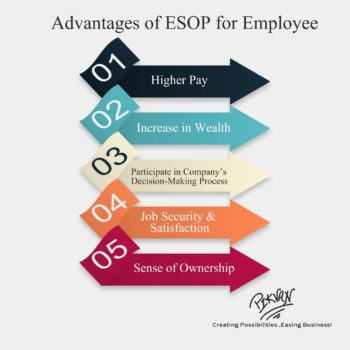

The ESOP benefits employees as company contributions are made annually to the ESOP, as both cash and stock. ESOP benefits are allocated to the accounts of participating employees in the trust established as part of the ESOP. The accumulated balance in a participant’s account is distributed to the participants after his or her retirement or other termination of employment with the company.

Employee Stock Option Plan (ESOP)

Apart from, directors and promoters of the company, who have more than 10% equity in the company, all employees are eligible for ESOP, provided they meet the criteria set such as:

1. Director of the company (full or part-time).

2. An employee of a subsidiary, associate or holding located in India or abroad.

3. Employees (permanent) working in foreign or Indian office.

Employee Stock Option Plan (ESOP)

ESOPs are a form of aligned incentives. They create ownership interest among employees so that they work together for the common goal of company growth. This leads to a highly motivated workforce that wants to achieve more so that their organization’s share value appreciates. All other benefits that a company enjoys are related to the same fact. Researches have shown that after exercising their ESOPs, employees show more loyalty to the company. They work in harmony to reduce wastage in the organization and brainstorm on finding new ways of increasing productivity. ESOPs also increase the employees’ trust in the management and the company itself.

Employee Stock Option Plan (ESOP)

Employee Stock Option Plan (ESOP) is a benefit given to employees from the company, where the employee receives “x” number of shares after completing a specified task or tenure with the company. The employee gets company shares at a reduced rate as compared to the market rate.

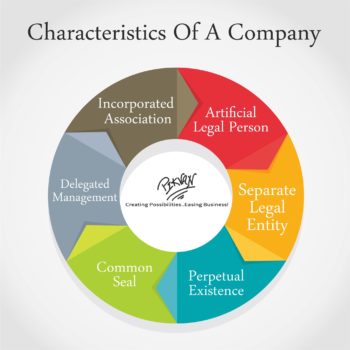

According to the Companies Act, 1956, “A company is a person, artificial, invisible, intangible, and existing only in the contemplation of the law. Being a mere creature of the law, it possesses only those properties which the character of its creation confers upon it either expressly or as incidental to its very existence.”

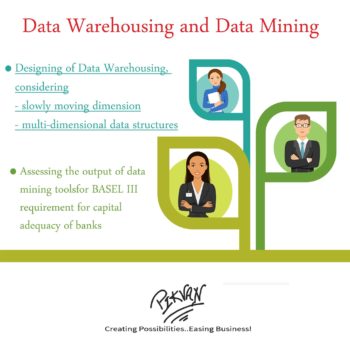

Data Warehousing & Data Mining

A database consists of one or more files that need to be stored on a computer. In large organizations, databases are typically not stored on the individual computers of employees but in a central system. This central system typically consists of one or more computer servers. A server is a computer system that provides a service over a network CAs Can play an extensive role in.

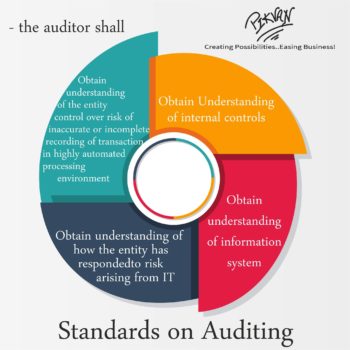

IT Audit

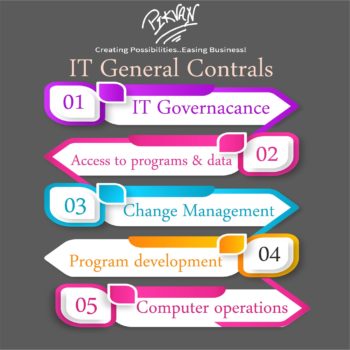

IT general control also be referred to as general computer control which is defined as "control, other than application controls, which relate to the environment within which computer-based application system is developed, maintained and operated, and which are therefore applicable to all applications"

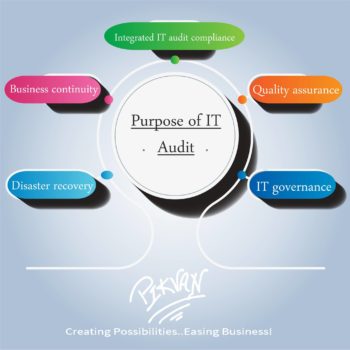

IT Audit

An IT audit is different from a financial statement audit. While a financial audit's purpose is to evaluate whether an organization is adhering to standard accounting practices, the purposes of an IT audit are to evaluate the systems internal control design and effectiveness. This includes, but is not limited to, efficiency and security protocols, development processes, and IT governance or oversight.